Introduction

In today’s rapidly evolving business landscape, the importance of efficient financial management cannot be overstated. At the heart of this efficiency is the concept of automating financial and accounting workflows. As businesses grow and financial transactions become more complex, the traditional methods of handling financial tasks become increasingly inadequate. Reaping the benefits of automating financial and accounting workflows isn’t just a trend. It’s a fundamental shift in how companies approach their finances.

Why Automate Financial and Accounting Workflows?

The primary allure of automating financial and accounting workflows lies in its ability to transform traditionally time-consuming and error-prone processes into streamlined, efficient, and accurate operations. Automation technologies have revolutionized the way financial data is processed. It offers real-time insights and frees up valuable resources to focus on more strategic tasks. The benefits of automating financial and accounting workflows extend beyond mere efficiency. They pave the way for enhanced decision-making, compliance adherence, and strategic financial planning.

As we delve deeper into the benefits of automating financial and accounting workflows, it’s important to recognize that this is not just about replacing manual work with software. It’s about reimagining the entire financial management process to be more responsive, agile, and capable of handling the dynamic needs of modern businesses. From startups to multinational corporations, the push towards automation is reshaping the financial landscape. It offers unprecedented opportunities for growth and innovation.

In the following sections, we’ll explore the myriad benefits of automating financial and accounting workflows, how they can transform your financial decision-making, and the tools and strategies to implement them effectively. Whether you’re a financial manager looking to improve your processes or a business leader seeking to optimize your organization’s financial health, understanding the power of automation is key to staying competitive in today’s market.

Why Automate Financial and Accounting Workflows?

Understanding the rationale behind the move towards automation is critical for any business considering this transformation. The benefits of automating financial and accounting workflows are multifaceted. They can bring substantial improvements to various aspects of a company’s operations.

Increased Accuracy and Reduced Errors

One of the most compelling reasons to automate financial and accounting workflows is the significant increase in accuracy it brings. Manual data entry, a common practice in traditional financial processes, is prone to human error. These errors can range from minor inaccuracies to significant discrepancies that can affect financial reporting and decision-making. Automated systems, on the other hand, ensure that data is processed consistently and accurately. This reduces the risk of errors and the time spent on rectifying them. This heightened accuracy is crucial for maintaining reliable financial records and making informed business decisions.

Enhanced Efficiency and Time Savings

Time is a valuable asset in business, and automating financial and accounting workflows can free up a substantial amount of it. Automation streamlines repetitive and time-consuming tasks such as data entry, invoice processing, and reconciliation. This shift from manual to automated processes speeds up these tasks. It also allows financial professionals to focus on more strategic activities, such as analyzing trends and advising on financial decisions. The efficiency gained through automation can be a game-changer for businesses. It enables them to respond more quickly to market changes and opportunities.

Improved Compliance and Audit Readiness

In an era where regulatory compliance is becoming increasingly complex, the benefits of automating financial and accounting workflows extend into the realm of compliance and audit readiness. Automated systems can be programmed to adhere to the latest regulatory requirements, ensuring that businesses remain compliant with minimal effort. They also provide detailed audit trails and easy access to financial records. This simplifies the audit process and reduces the risk of non-compliance penalties. This aspect of automation not only safeguards the business but also instils confidence in stakeholders regarding the company’s financial integrity.

Omnitas Newsletter

Sign up for our monthly newsletter to stay up-to-date on our latest blog articles, videos and events!

Thank you!

You have successfully joined our subscriber list.

Key Benefits of Automating Your Financial Processes

Delving deeper into the advantages, the benefits of automating financial and accounting workflows are not only operational but also strategic. Let’s explore some of these key benefits that can redefine the way businesses handle their finances.

Real-time Financial Data Analysis

In the age of digital transformation, having access to real-time financial data is a game changer. Automation enables continuous and instantaneous analysis of financial data. It offers insights that were previously inaccessible due to the time lag in manual processing. This immediate availability of data allows businesses to make quicker, more informed decisions, adjust strategies promptly in response to market changes, and identify opportunities and risks as they arise. Real-time analysis also fosters a more dynamic and proactive approach to financial management, positioning businesses for better agility and competitiveness.

Streamlined Processes and Reduced Manual Workload

The streamlining of processes is a fundamental benefit of automating financial and accounting workflows. Automation transforms complex, multi-step financial procedures into seamless operations. This eliminates the need for manual intervention in tasks like invoice processing, payroll, and expense management. This reduction in manual workload minimizes the chances of human error. It also leads to a more efficient allocation of human resources. Employees can focus on more value-adding activities. These include strategic planning and analysis, rather than getting bogged down by routine tasks.

Scalability and Flexibility in Financial Operations

Automation brings scalability and flexibility to financial operations. These are key factors for businesses aiming for growth and adaptation in a dynamic economic environment. As a company expands, its financial operations become more complex. Automated systems can easily scale to handle increased transaction volumes and complexity without the need for proportional increases in staff or resources. This scalability ensures that financial workflows remain efficient and effective, regardless of the size and scope of the business. Moreover, automated systems offer the flexibility to adapt to changing business models, market conditions, and regulatory requirements. This ensures that financial operations are always aligned with the business’s current needs.

How Automation Transforms Financial Decision-Making

The impact of automating financial and accounting workflows extends into the realm of strategic decision-making. Automation doesn’t just change how tasks are executed; it revolutionizes the very way financial decisions are made. Let’s explore this transformative power.

Data-Driven Insights for Better Financial Strategies

Automation equips businesses with powerful data-driven insights, fostering a more analytical approach to financial strategy. With automated tools, companies can quickly gather and analyze large volumes of financial data, uncovering patterns and trends that might be invisible in a manual setup. This wealth of information leads to better-informed decisions, from identifying cost-saving opportunities to optimizing investment strategies. By basing decisions on solid, data-driven insights, businesses can craft financial strategies that are both robust and responsive to market dynamics.

Proactive Cash Flow Management

Effective cash flow management is the cornerstone of financial stability, and automation plays a pivotal role in achieving this. Automating financial and accounting workflows provides a real-time view of cash flow, allowing businesses to manage their resources more effectively. This proactive approach helps in anticipating cash flow shortages and surpluses, ensuring optimal liquidity. Automated forecasting tools also allow for scenario planning, helping businesses prepare for various financial situations and make strategic decisions to maintain a healthy cash flow.

Enhanced Forecasting and Budgeting

Automation transforms the often cumbersome process of forecasting and budgeting into a more efficient and accurate exercise. Automated systems can integrate data from various sources, providing a holistic view of the business’s financial health. This integration enables more precise forecasting, helping businesses anticipate future trends and make strategic adjustments. Additionally, automation simplifies budgeting, allowing for quicker adjustments and more effective allocation of resources. This enhanced forecasting and budgeting capability is crucial for businesses aiming to stay agile and responsive in a constantly changing economic environment.

Tools and Technologies for Financial Workflow Automation

To harness the full benefits of automating financial and accounting workflows, it’s essential to understand the tools and technologies that make it possible. This section will introduce some of the key solutions that can transform your financial processes.

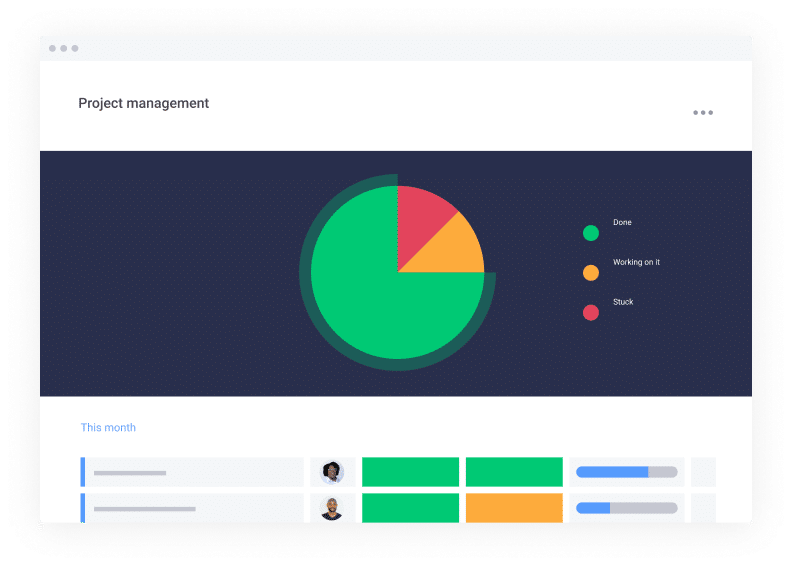

Integrating monday.com for Work Management

monday.com stands out as a versatile tool that can significantly enhance financial workflow automation. It’s not just a work management platform; it’s a comprehensive solution that can streamline various financial processes. With its customisable workflows, monday.com enables businesses to automate tasks such as budget tracking, invoice management, and financial reporting. Its user-friendly interface and integration capabilities make it an ideal choice for teams looking to collaborate effectively while managing financial tasks. By leveraging monday.com, businesses can ensure that their financial workflows are well-organized, transparent, and efficient.

Leveraging Make for Automated Workflows

Make is another powerful tool that can automate complex financial workflows with ease. It allows for the creation of custom, automated workflows that connect various apps and services. For instance, you can automate the transfer of data between your CRM, accounting software, and other financial tools, ensuring seamless data synchronization and process efficiency. Make’s ability to handle complex logic and multiple steps in a workflow makes it an invaluable asset for automating financial and accounting workflows. It simplifies the process, reduces the chance of errors, and saves time, allowing financial teams to focus on more strategic tasks.

Choosing the Right Tools for Your Business Needs

While monday.com and Make are excellent examples, the right tool for your business may vary depending on your specific needs and existing systems. When selecting tools for automating financial and accounting workflows, consider factors such as ease of use, integration capabilities, scalability, and support. It’s also important to assess how these tools align with your financial objectives and the overall digital strategy of your business. Proper evaluation and selection of these tools are crucial in ensuring that the automation of your financial workflows is successful and delivers the desired benefits.

Implementing Automation in Your Financial Workflows

Adopting automation in financial and accounting workflows is a strategic move that requires careful planning and execution. This section provides insights into best practices for implementing automation effectively in your financial processes.

Best Practices for a Smooth Transition

The transition to automated financial workflows should be approached with a strategic plan. Begin by identifying the processes that will benefit most from automation, such as invoicing, expense tracking, or payroll management. It’s essential to involve key stakeholders in this planning phase, including finance team members and IT professionals, to ensure that the chosen solution aligns with the needs and capabilities of your organization. Gradual implementation, rather than an overnight switch, often yields better results, allowing employees to adapt to new systems and processes. Additionally, ensure that there is adequate training and support available to facilitate a smooth transition.

Training and Skill Development for Teams

Training is a critical component of implementing automation in financial workflows. It’s crucial to equip your team with the necessary skills and knowledge to use new tools effectively. This training should cover not only the technical aspects of the new systems but also the changes in workflow and processes. Encourage a culture of continuous learning and improvement, as this will help your team to adapt to new technologies and make the most of automated systems. Providing ongoing support and resources for skill development is key to maximizing the benefits of financial workflow automation.

Measuring the Impact and ROI of Automation

Once automation is implemented, it’s important to measure its impact on your financial workflows. Key performance indicators (KPIs) such as processing time, error rates, and employee productivity can provide valuable insights into the effectiveness of automated processes. Assessing the return on investment (ROI) of automation initiatives is also crucial. This involves comparing the costs associated with implementing and maintaining automated systems against the savings and gains achieved through increased efficiency, accuracy, and strategic decision-making. Regularly reviewing and analyzing these metrics will help you understand the value added by automation and guide further improvements.

Future of Finance: The Role of Automation

As we look towards the future, it’s clear that automation will continue to play a pivotal role in shaping the financial landscape. This final section explores emerging trends and how businesses can prepare for the advancements in financial workflow automation.

Emerging Trends in Financial Automation

The field of financial automation is rapidly evolving, driven by advancements in technology and changing business needs. One of the most significant trends is the integration of artificial intelligence (AI) and machine learning, which are set to offer even more sophisticated analytical capabilities and predictive insights. Another trend is the increasing use of blockchain technology for secure and transparent financial transactions. Additionally, the rise of cloud-based financial systems is making automation more accessible and scalable for businesses of all sizes. These trends indicate a future where financial workflows are not only automated but are also more intelligent, secure, and adaptable.

AI and Machine Learning in Financial Workflows

AI and machine learning are transforming financial workflows by enabling more advanced data analysis and decision-making capabilities. These technologies can automate complex analytical tasks, predict financial trends, and provide deeper insights into market behaviours and customer preferences. The application of AI in risk management, fraud detection, and personalized financial services is also becoming increasingly prevalent. As these technologies mature, they will become integral components of financial workflow automation, offering businesses new ways to optimize their financial operations.

Preparing for a Technologically Advanced Financial Environment

To stay ahead in a rapidly changing financial environment, businesses need to be proactive in adopting new technologies. This involves staying informed about emerging trends, investing in the right tools and technologies, and fostering a culture that embraces innovation and adaptability. It’s also important to focus on developing a skilled workforce that can leverage these technologies effectively. By preparing for these advancements, businesses can ensure that they are well-positioned to take advantage of the opportunities presented by the future of financial workflow automation.

In conclusion, the benefits of automating financial and accounting workflows are clear and multifaceted. From increased efficiency and accuracy to enhanced decision-making and compliance, automation is redefining the way businesses manage their finances. As we look to the future, the role of automation in finance is set to become even more significant, with emerging technologies offering new possibilities for innovation and growth. Embracing these changes is not just a matter of staying competitive; it’s about seizing opportunities to transform your financial operations for the better.

Conclusion

As we’ve explored throughout this post, the benefits of automating financial and accounting workflows are undeniable. Automation brings not only enhanced efficiency and accuracy but also a transformative impact on financial decision-making, compliance, and strategic planning. The use of tools like monday.com and Make offers seamless integration, real-time data analysis, and scalability, making them invaluable assets in the financial toolkit of modern businesses.

The future of finance is undeniably intertwined with automation, as emerging technologies like AI, machine learning, and blockchain continue to push the boundaries of what’s possible in financial management. For businesses aiming to stay competitive and adaptable in this rapidly evolving landscape, embracing automation is no longer optional; it’s imperative.

At Omnitas, we understand the critical role that effective financial workflow automation plays in the success of your business. Our expertise in integrating solutions like monday.com and Make positions us as the ideal partner to guide you through this transformative journey. Whether you’re just starting out with automation or looking to optimize your existing processes, our team is equipped to provide you with the tools, knowledge, and support to achieve your financial management goals.

Ready to take your financial workflows to the next level? Book a free consultation with us at Omnitas below. Discover how we can help you harness the power of automation with monday.com and Make, tailor solutions to your unique business needs, and propel your financial operations into a new era of efficiency and strategic insight.

If you enjoyed this blog article, make sure to subscribe to our monthly newsletter below to stay in the loop on all things business efficiency and automation!